Financials

Financial Statements And Related Announcement - Second Quarter And/ Or Half Yearly Results

Financials Archive![]() Note: Files are in Adobe (PDF) format.

Note: Files are in Adobe (PDF) format.

Please download the free Adobe Acrobat Reader to view these documents.

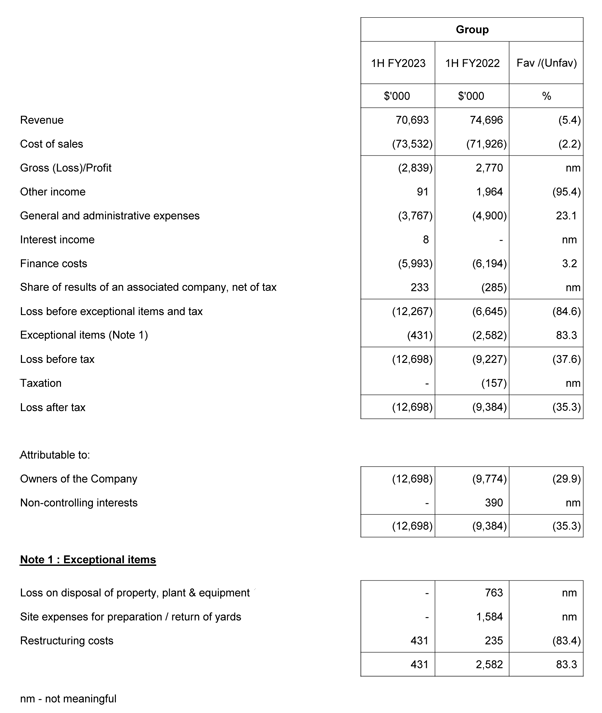

Condensed Interim Consolidated Income Statement

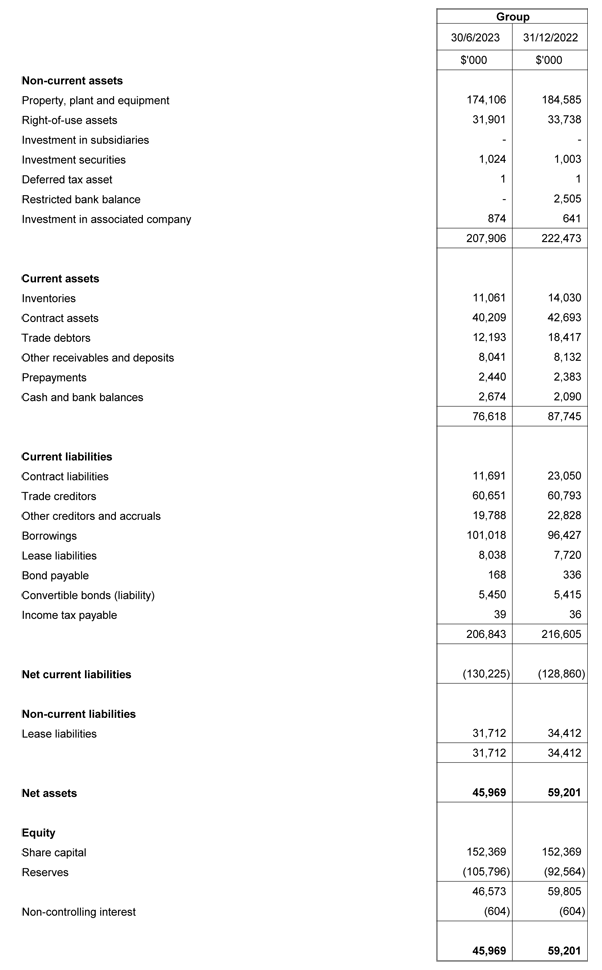

Condensed Interim Balance Sheet

Review of Performance

The Group's revenue for the 6 months ended 30 June 2023 ("1H FY2023" or Review Period) decreased marginally by 5.4% to $70.1 million compared to $74.7 million in the previous corresponding period ended 30 June 2022 ("1H FY2022").

Revenue from Specialist Civil Engineering projects increased by 15.0% from $46.6 million in 1H FY2022 to $53.6 million in 1H FY2023. Contributions for the Review Period came mainly from MRT CR102, MRT J109, Changi Airport T5 ARC, North-South Corridor N111 and N103 projects, as well as infrastructural projects in Hong Kong.

Revenue from Structural Steelwork decreased by 39.0%, from $28.0 million in 1H FY2022 to $17.1 million in 1H FY2023. Key contributors include projects for Punggol Sport Hub Complex, Singapore General Hospital, Mandai Crematorium and ICA Building. The decrease in Structural Steelwork revenue is mainly due to certain projects reaching their tail end and hence lower work done.

As construction costs remained high and the labour market remained tight, the Group's project margins remain challenged, leading to the Group incurring a gross loss in 1H FY2023 of $2.8 million, compared to a gross profit of $2.8 million in 1H FY2022.

Other income decreased from $1.96 million in 1H FY2022 to $0.09 million in 1H FY2023 mainly due to lower Government wage credit scheme and rebates for foreign worker levies received during the Review Period.

General and administrative expenses reduced by 23.1% to $3.8 million in 1H FY2023, compared to $4.9 million in 1H FY2022. The reduction was mainly due to lower professional fees and higher gains on disposal of certain fixed assets in 1H FY2023.

Finance costs reduced slightly to $6.0 million in 1H FY2023 compared to $6.2 million in 1H FY2022, due to lower bond interest for the period. However, interest rates on loans and other borrowings were higher during the Review Period.

Consequently, the Group incurred a loss before tax of $12.7 million in 1H FY2023, compared to a loss before tax of $9.2 million in 1H FY2022. Net asset value per share decreased from 8.50 cents as at 31 December 2022 to 6.62 cents as at 30 June 2023.

The Group's net gearing is at 2.26 times as at 30 June 2023, compared to 1.65 times as at 31 December 2022.

Commentary

On 25 January 2023, the Group filed an application for moratoria pursuant to Sections 64 & 65 of The Insolvency, Restructuring and Dissolution Act 2018 to the Singapore High Court, in respect of both the Company and the Group's key subsidiary, Yongnam Engineering & Construction (Private) Limited ("YNEC"). The High Court granted the moratoria on 13 February 2023 for a period of 3 months expiring on 15 May 2023. The Group subsequently applied for and was granted an extension of the moratoria by a period of three months until 15 August 2023.

On 13 April 2023, the Group announced that it had entered into definitive agreements with Turbo Vision Pte. Ltd in relation to the following:

(a) a loan agreement for a term loan in the principal amount of $3,000,000; and

(b) a conditional subscription agreement (the "Subscription Agreement") for the following:

(i) subscription by the Subscriber of $20,000,000 in new ordinary shares in the Company, on the terms and conditions of the Subscription

Agreement; and

(ii) subscription by the Subscriber of two tranches of unlisted share options ("Options"), with the first tranche being non-transferable, having a

principal amount of $10,000,000 and expiring one year from the date of its issue; and the second tranche being transferable, having a principal

amount of $20,000,000 and expiring three years from the date of its issue, with each Option carrying the right to subscribe for one new ordinary

share in the Company per Option, on the terms and conditions of the Subscription Agreement.

The Group has been in discussion with its major secured creditors, unsecured creditors, and the potential investor, Turbo Vision Pte. Ltd, on the restructuring of the financial indebtedness of the Group.

The above proposed transactions are intended to place the Group in a position to carry out a scheme of arrangement with certain of the Group's unsecured creditors and to negotiate settlement arrangements in relation to existing facilities with the Group's lenders. Therefore, the proposed transactions, when completed, will provide certainty of funding for the Group to continue as a going concern and to secure new projects in the near future.

The Group has filed an application to extend the moratoria for a further 3 months until 15 November 2023 to complete the discussions with its major lenders (the "Moratoria Extension Applications").

On 4 August 2023, United Overseas Bank Ltd filed applications to place the Company and YNEC under judicial management (the "JM Applications"). Malayan Banking Berhad, Singapore Branch and its syndicate of lenders (the "Maybank Syndicate") have also filed an affidavit in support of the JM Applications, save for the choice of the proposed judicial managers. The JM Applications will be heard together with the Moratoria Extension Applications on 14 August 2023. In this regard and in light of the position taken by the Maybank Syndicate, the Company and YNEC will be seeking leave to withdraw the Moratoria Extension Applications at the hearing on 14 August 2023. The Group shall make further announcements as appropriate.

Due to the financial difficulties faced by the Group, it has become much more challenging for the Group to secure new projects. As at 30 June 2023, the Group's order book is $363.3 million.